Yield to maturity calculator ba ii plus 323608-Yield to maturity calculator ba ii plus

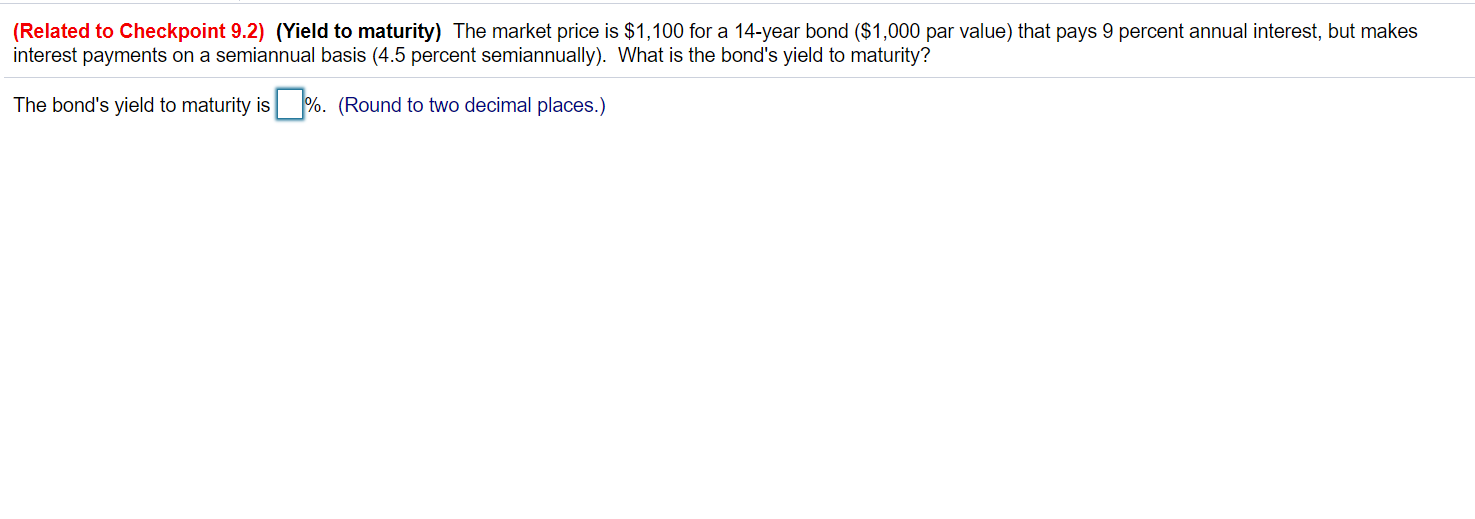

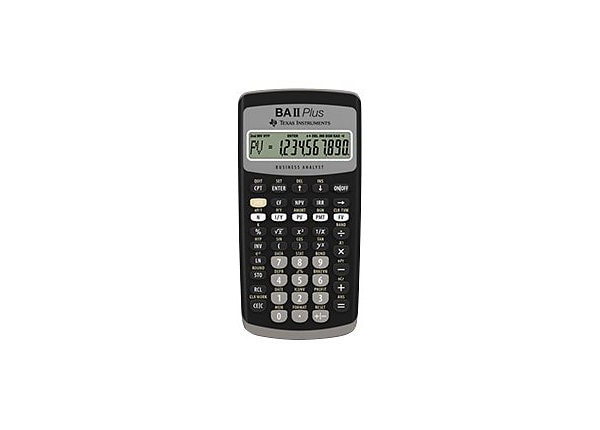

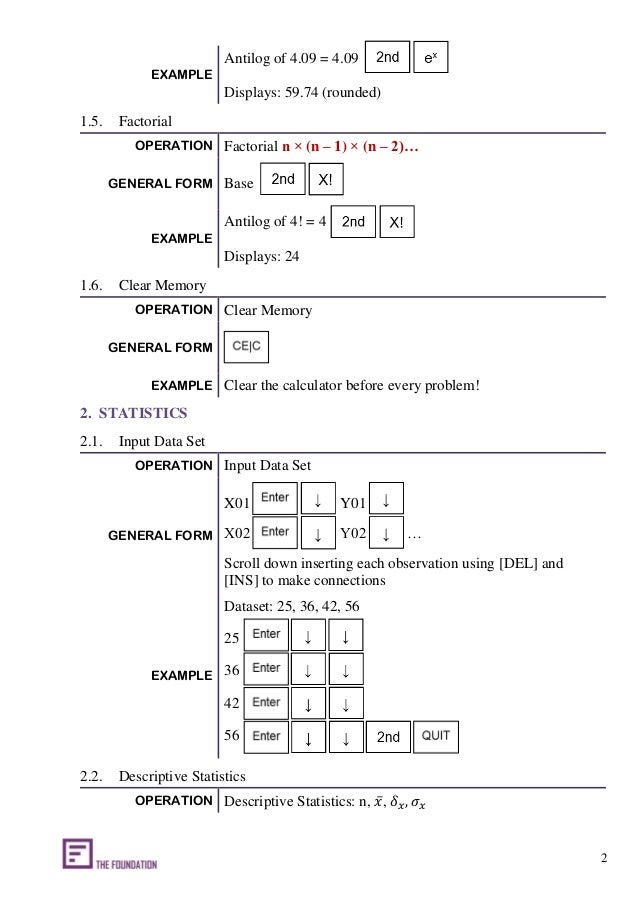

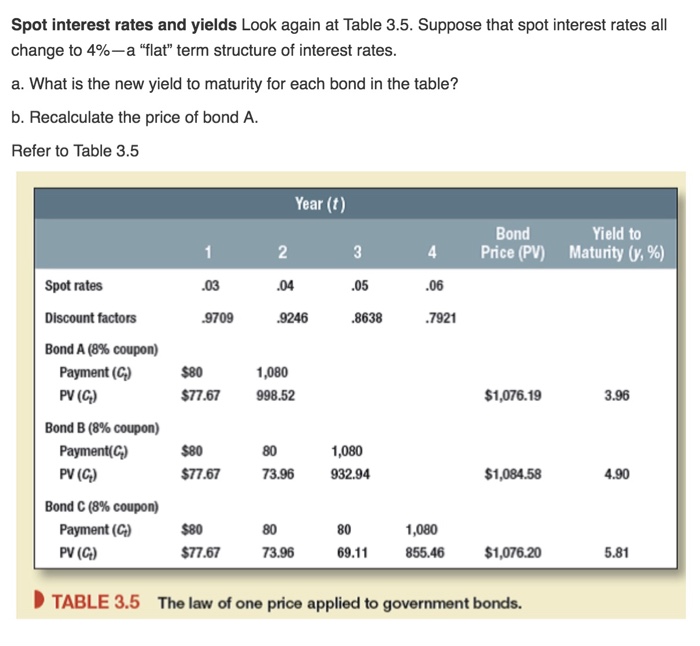

Listbased onevariable and twovariable statistics with four regression options linear, logarithmic, exponential and power Math functions include trigonometric calculations, natural logarithms, and powersGiven four inputs (price, term/maturity, coupon rate, and face/par value), we can use the calculator's I/Y to find the bond's yield (yield to maturity) ForThere is no formula that can be used to calculate the exact yield to maturity for a bond (except for trivial cases) Instead, the calculation must be done on a trialanderror basis This can be tedious to do by hand Fortunately, the BAII Plus has the time value of money keys, which can do the calculation quite easily

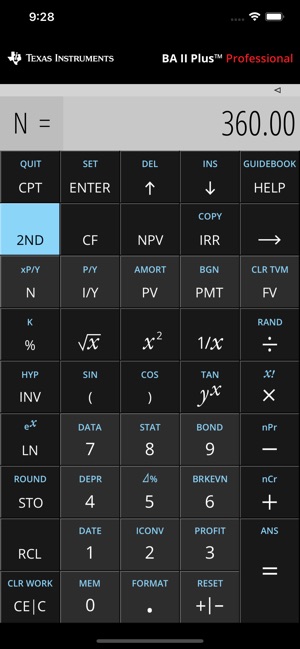

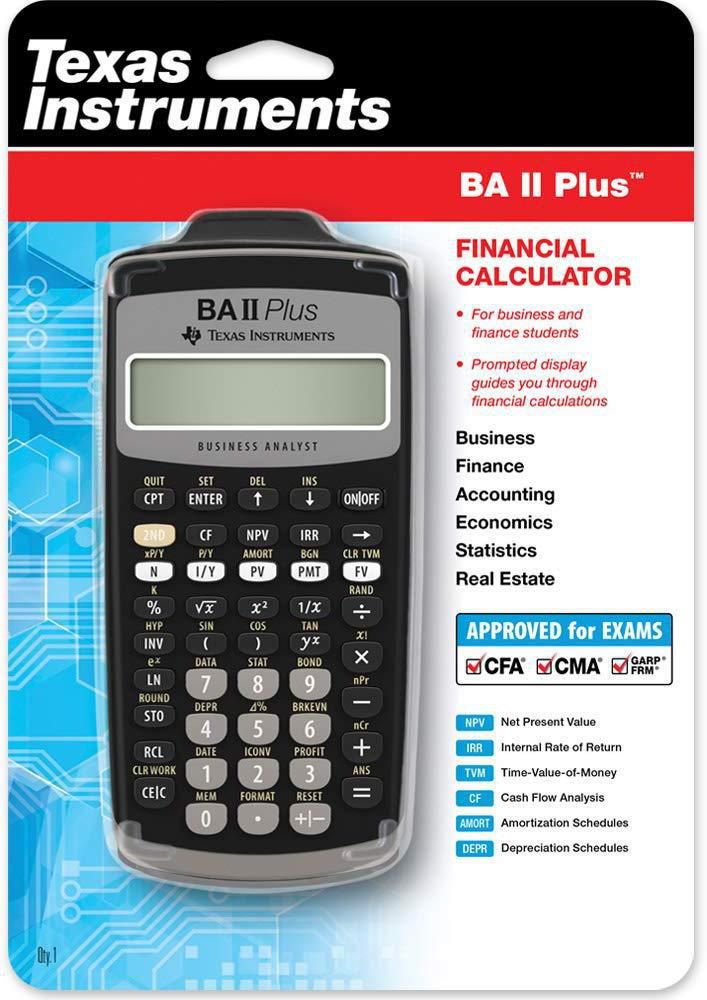

Cfa Calculator Texas Instruments Ba Ii Plus Professional Financial Are You Preparing For Your Cfa Exam And In Need Of The Cfa Approved Calculator Then Contact Us To Buy One In Nigeria We Have The Texas Instruments Ba Ii Plus Professional

Yield to maturity calculator ba ii plus

Yield to maturity calculator ba ii plus-Texas Instruments BA II plus Financial Calculator for business professionals and students features are that it performs common math as well as various financial functions;Bond prices and yield to call or maturity

Texas Instruments Baii Financial Calculator Ba Ii Plus

Current Yield to Maturity Calculator Inputs Current Bond Trading Price ($) The price the bond is trading at today Bond Face Value/Par Value ($) The par value or face value of the bond Years to Maturity The numbers of years until bond maturity (You can enter decimals to represent months and days)Yield to Maturity Calculator is an online tool for investment calculation, programmed to calculate the expected investment return of a bond This calculator generates the output value of YTM in percentage according to the input values of YTM to select the bonds to invest in, Bond face value, Bond price, Coupon rate and years to maturityLook at the example below An investor purchased an optionfree bond with 6 years to maturity, the par value equal to USD 100 and both an annual coupon and a yield to maturity equal to 10%

R – Rate of Interest;Yield to Maturity Calculator Inputs Current Bond Trading Price ($) The price the bond trades at today Bond Face Value/Par Value ($) The face value of the bond, also known as the par value of the bond Years to Maturity The numbers of years until bond maturity;Maturity Value Formula The following formula can be used to calculate the maturity value of an investment V = P * (1R)^T V – Maturity Value;

YTM Calculator The YTM calculator has two parts, one is to calculate the current bond yield, and the other is to calculate yield to maturity Bond Yield Formula Following is the bond yield formula on how to calculate bond yield Current Bond Yield (CBY) = F*C/P, where C = Bond Coupon Rate F = Bond Par Value P = Current Bond PriceSums and Sequences on the TI Plus and TI84 Plus;How do you calculate yield on BA II Plus?

New Texas Instruments Ba Ii Plus Financial Calculator Case Ti Baii 2 Finance 22 99 Picclick

Solved If Someone Can Show How To Solve This With A Ba Ii Chegg Com

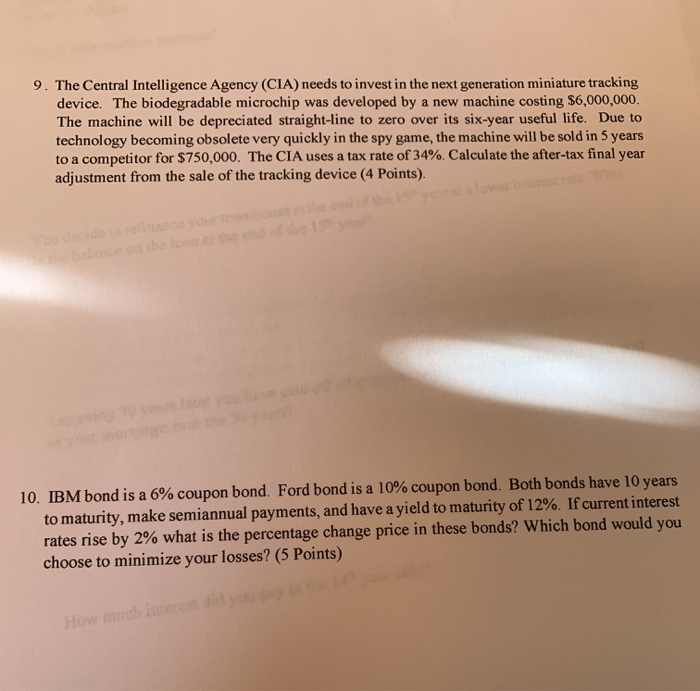

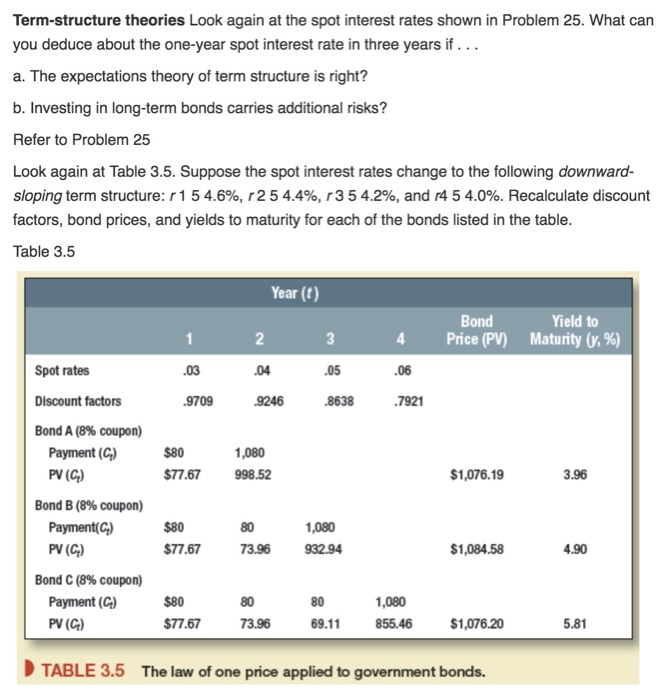

T has 10 years left to maturity and the current market rate is 684% Calculate the modified duration on the bond *Note In your BA II Plus Professional calculator dates are entered in the mmddyy format It is useful to use an easy starting date, such as 01/01/00 and add the time to maturity to it to determine the ending dateCalculator offers depreciation schedules;This interest rate is often interpreted as a measure of the average rate of return that will be earned on a bond if it is bought nor and held until maturity To calculate the yield to maturity, we solve the bond price equation for the interest rate given the bond's price Example 8% Coupon, 30year bond selling at $ Remaining 60

Texas Instruments Ba Ii Plus Financial Calculator Tabalonline Tabalonline

User Manual For Texas Instrument Ba Ii Plus Professional Peatix

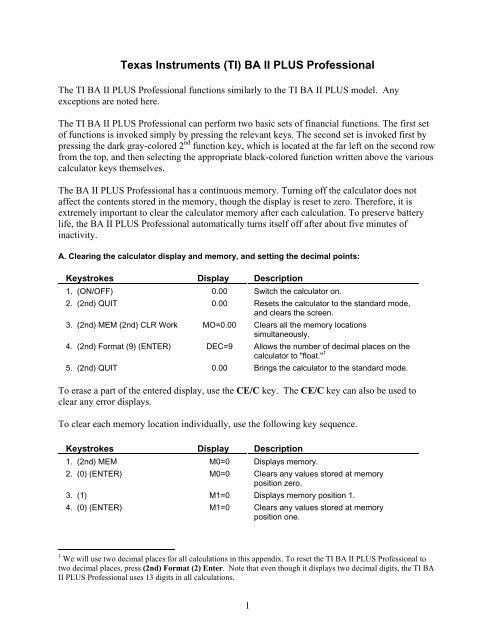

Page 2 Important Information Important Information Texas Instruments makes no warranty, either express or implied, including but not limited to any implied warranties of merchantability and fitness for a particular purpose, regarding any programs or book materials and makes such materials available solely on an "asis" basisHow do you calculate yield on BA II Plus?It teaches you how to use the calculator to calculate the price of a bond What is the price of a 10year $1,000 face value bond with a coupon rate of 40% that pays annually, if the yield is 60%?

Ba Ii Plus Tm Financial Calculator Online Game Hack And Cheat Gehack Com

Brief Tutorial For The Texas Instruments Baii Plus

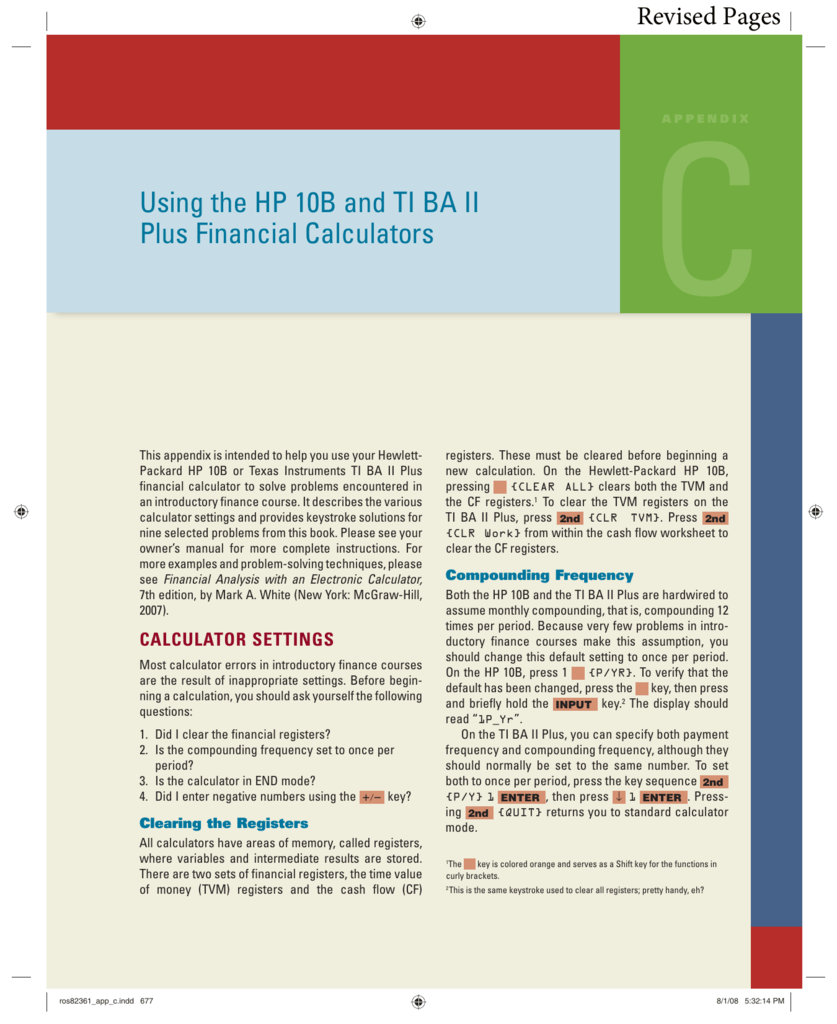

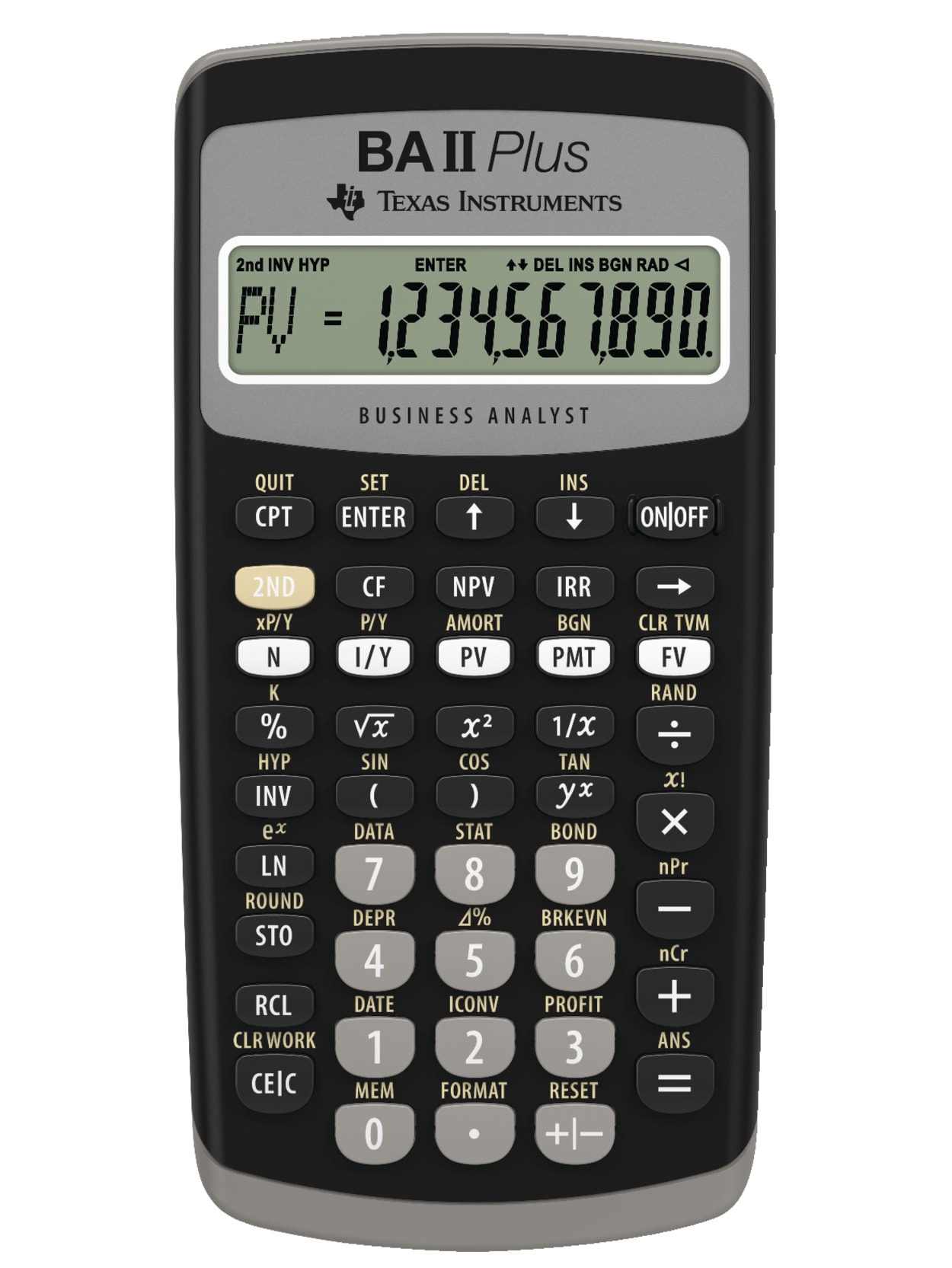

Calculating Basic Loan Interest with BA II Plus The monthly payment on my condo is $926 I originally took out a 30 year, $0,000 mortgage on the property4 BA II PLUS™ Calculator Keys and 2nd Functions The primary function of each key is printed on the key For example, press $ to turn the calculator on or off Some keys provide a secondary function which is printed in yellow above the key When you press &, the character, abbreviation, or word printed above a key becomes active for theChanging the Number of Decimals Displayed on the TI BA II Plus and HP 12c;

Solved Please Show All Work With 4 Decimal Points On Calc Chegg Com

Solved I Need The Steps For Calculating The Following Pro Chegg Com

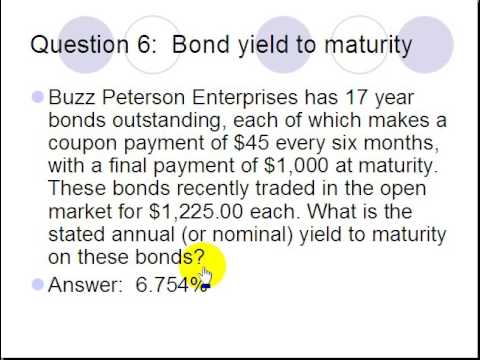

Formula to Calculate YTM Yield to Maturity Formula refers to the formula that is used in order to calculate total return which is anticipated on the bond in case the same is held till its maturity and as per the formula Yield to Maturity is calculated by subtracting the present value of security from face value of security, divide them by number of years for maturity and add them with couponFinancial Management for Engineers Fall Calculating yield (Bond) using BA II Plus Calculator 2 nd Bond 2 nd Clr work Enter enters settlement date 7 Enter enters annual coupon rate 12 3197 Enter enters redemption date 100 Enter enters face value of Bond 360 Enter enters no of days in one year 2/Y Enter enters 2 coupon payments per year shows Yld = 0 Shows Pri = 0 98Maturity Value Definition A maturity to value is a measure of how much an investment will make at "maturity"

Shopee Malaysia Free Shipping Across Malaysia

Yield To Call Of A Bond On The Baii Plus Youtube

Page 1 BA II PLUS™ Calculator;Weusestandard arithmetic operators instandard calculator mode withthefollowing keystrokes 109Z3I; The yieldtomaturity can befound using thecalculator inthe bond worksheet asfollows SDT=(enter610), Review of Calculator Functions For The Texas Instruments BA II PlusT – Time of Investment;

Texas Instruments Ba Ii Plus Adv Financial Calculator Baiiplus Best Buy

Ti Baii Calculator 2nd Clrtvm 1000 Fv 50 Pmt 10 N 6 Iy Cpt Pv Factors Course Hero

How to calculate the horizon yield in the most efficient and fastest way using approved CFA® exam calculator?Page 124 M = number of coupon periods per year standard for the particular security involved (set to 1 or 2 in Bond worksheet) DSR = number of days from settlement date to redemption date (maturity date, call date, put date, etc) BA II PLUS™ CalculatorFour methods for calculating depreciation, book value, and remaining depreciable amount SL, SYD, DB, DB with SL crossover;

Cfa Calculator Texas Instruments Ba Ii Plus Professional Financial Are You Preparing For Your Cfa Exam And In Need Of The Cfa Approved Calculator Then Contact Us To Buy One In Nigeria We Have The Texas Instruments Ba Ii Plus Professional

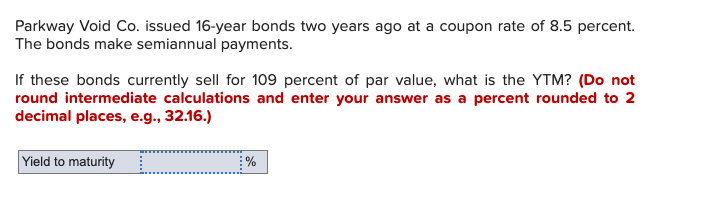

How Can You Compute This On The Baii Plus Calculator Parkway Void Co Issued 16 Year Bonds Homeworklib

Sums and Sequences on the TI Plus and TI84 Plus;To calculate the YTM, just enter the bond data into the TVM keys We can find the YTM by solving for I/Y Enter 6 into N, into PV, 40 into PMT, and 1,000 into FV Now, press CPT I/Y and you should find that the YTM is 475% Click to see full answerPlease see the Initial Setup section of the BAII Plus tutorial for how to correct this problem) Notice that the bond is currently selling at a discount (ie, less than its face value) This discount must eventually disappear as the bond approaches its maturity date

New Texas Instruments Ba Ii Plus Financial Calculator Students Recourse Dha

Frm Ti Ba Ii To Compute Bond Price Given Zero Spot Rate Curve Youtube

A Bond Has A Yield To Maturity Of 7 Percent A Bond Has A Yield To Maturity Of 7 Percent If The Inflation Rate Is 12 Percent, What Is The Real Rate Of Return On The Bond?P – Principal Invested;Two daycount methods (actual or 30/360) to calculate bond price or yield to maturity or to call;

Texas Instruments Calculator Baii Plus Professional

Http Faculty Babson Edu Goldstein Teaching 9e Financial Calculator Reference Pdf

If Coupon Rate Is More Than Yield To Maturity Provided by discountcabincom FREE Yield to Maturity (YTM) Overview, Formula, and Importance Provided by corporatefinanceinstitutecom FREE The coupon rate Coupon Rate A coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond for the bond is 15% and the bond will reach maturity in 7 yearsHow to Create a Simple Quadratic Formula Program on the TI and Voyage 0SAT Test Prep #1 Mean, Mode, and Median on the TI Plus, TI84 Plus, and TI;

Q Tbn And9gcqllhmdhbsaisafxxhpwzxau9wbqmxtkwbkali8wl Ensgsgrxw Usqp Cau

Ti Ba Ii Plus Calculator Ch

A Bond Has A Yield To Maturity Of 7 Percent A Bond Has A Yield To Maturity Of 7 Percent If The Inflation Rate Is 12 Percent, What Is The Real Rate Of Return On The Bond?This lesson is part 2 of 4 in the course Using Texas Instruments BA II Calculator This video demonstrates the basic functionality of the Texas Instruments BA II Plus Financial Calculator It teaches you how to use the calculator to calculate the yield of a bond Given four inputs (price, term/maturity, coupon rate, and face/par value), we can use the calculator's I/Y to find the bond's yield (yield to maturity)This finance calculator app for Android devices is very similar as BA II Plus Professional Financial Calculator This finance calculator app has the same usage and operation sequences with BA II Plus Professional Financial Calculator, and it provide scientific calculation function and financial calculation such as timevalueofmoney, amortization schedule, cash flow, and so on

Ba Ii Plus Ordinary Annuity Calculations Pv Pmt Fv Youtube

Mathematics Of Finance Solutions To The Examples In This Presentation Are Based On Using A Texas Instruments Baii Plus Financial Calculator Ppt Download

The Worksheet mode includes tables for amortization, bond, depreciation, and compound interest, Builtin memory for storage of previous worksheets, Can perform cashflowThe BA II Plus is a standard calculator with a variety of worksheet mode produced by Texas Instruments By far, the standard mode is mostly used to perform common math operations involving time value of money – applications such as mortgages or annuities (with equal and evenly spaced payments)Realized yield is the total return when a bond is sold prior to maturity For example, a bond maturing in three years with a 3% coupon purchased at face value of $1,000 has a yield to maturity of 3% If the bond is sold exactly one year after purchase at $960, the loss of principal is 4%

Www Actexmadriver Com Assets Clientdocs Prod Preview Tiba35p Guidebook Pdf

Ba Ii Plus Financial Calc On The App Store

Changing the Number of Decimals Displayed on the TI BA II Plus and HP 12c;This video is recorded by David from Bionic TurtleQuestion How Would You Plug This Into The BA II Plus Calculator To Solve?

Shopee Malaysia Free Shipping Across Malaysia

Ba Ii Plus Financial Business Accounting Economics Statistics Texas Instruments Ebay

How to calculate the horizon yield in the most efficient and fastest way using approved CFA® exam calculator?Listbased onevariable and twovariable statistics with four regression options linear logarithmic exponential and power Math functions include trigonometric calculations natural logarithms and powersSAT Test Prep #1 Mean, Mode, and Median on the TI Plus, TI84 Plus, and TI;

Ba Plus Pro Financial Calculator Apps On Google Play

Texas Instruments Ba Ii Plus Iibapl Tbl 1l1 Office Supplies Cdw Com

Without clearing the Bond registers, change the maturity date Input 14 15 Press 12 4 15 5 should be displayed Store the new call value Input 105 Press should be displayed Calculate the yield Press 454% should be displayed The yield to call would be 454%Look at the example below An investor purchased an optionfree bond with 6 years to maturity, the par value equal to USD 100 and both an annual coupon and a yield to maturity equal to 10%ChrisK87 @ Hi I am trying to calculate the yield to maturity for a bond, can't really figure out how to do it with the above mentioned calculator

Finding A Bond S Yield Using The Texas Instruments Ba Ii Plus Calculator Youtube

Finding Bond Price And Ytm On A Financial Calculator Youtube

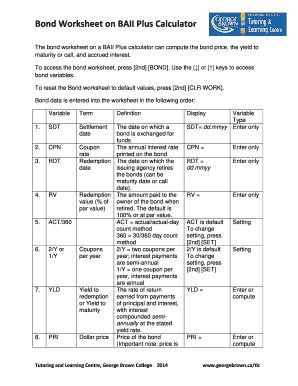

Bond YTM Calculator Outputs Yield to Maturity (%) The converged upon solution for the yield to maturity of the bond (theThe bond worksheet on a BAII Plus calculator can compute the bond price, the yield to maturity or call, and accrued interest To access the bond worksheet, press 2nd BOND Use the ↓ or ↑ keys to access bond variablesAuthor Topic YTM with Texas Instr BA II Plus;

Ba Financial Calculator Pro Vicinno

Vandenberg Sdsu Edu Courses Fin323 Hp Ti Calculators Mcgraw Hill Pdf

To calculate a bond's yield to maturity, enter the face value (also known as "par value"), coupon rate, number of years to maturity, frequency of payments, and the current price of the bond How to Calculate Yield to Maturity For example, you buy a bond with a $1,000 face value and an 8% coupon for $900Calculator offers depreciation schedules;Page 1 BA II PLUS™ Calculator;

Can You Please Show Me How To Do This With Ba Ii Plus Financial Calculator Ccan Homeworklib

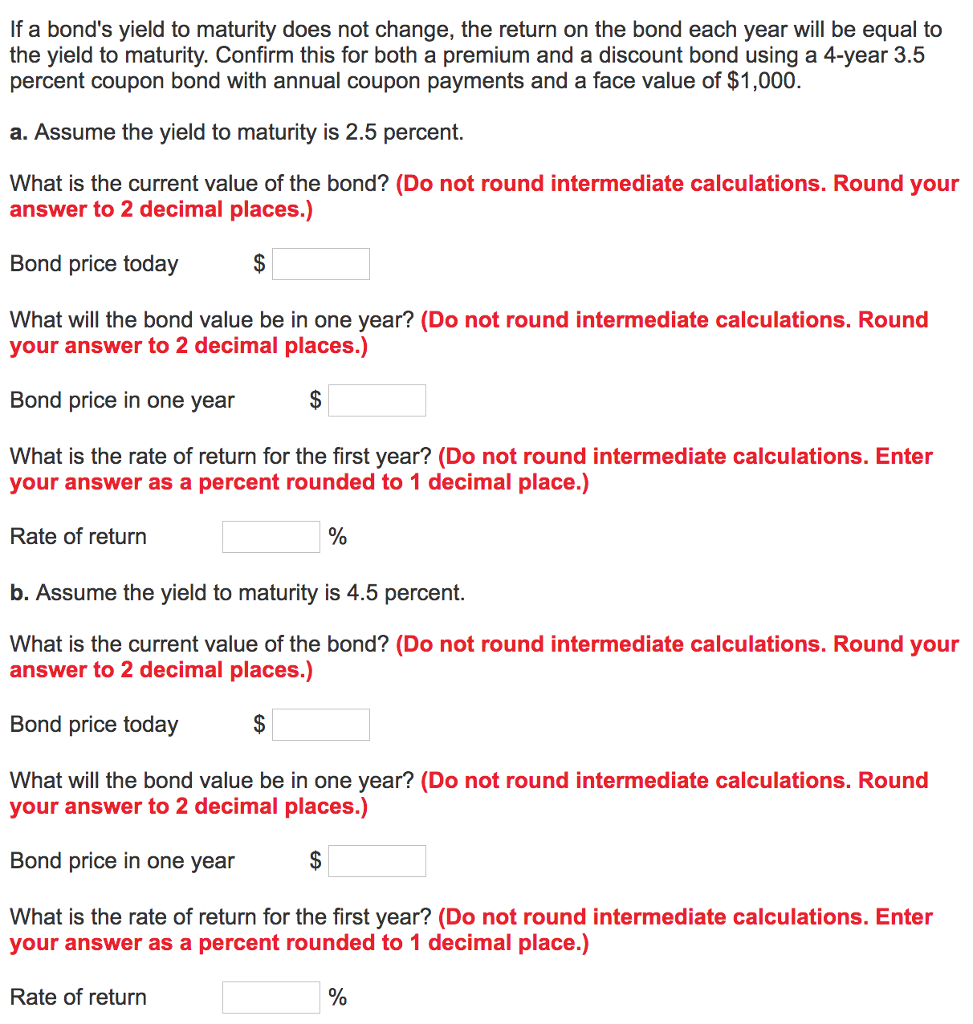

Solved If A Bond S Yield To Maturity Does Not Change The Chegg Com

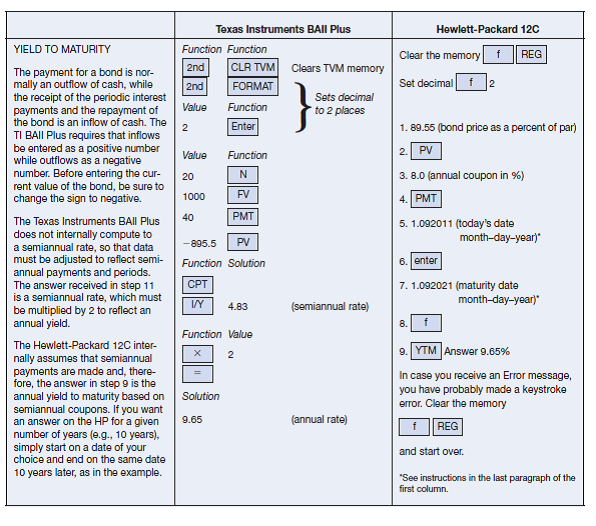

The bond worksheet on a BAII Plus calculator can compute the bond price, the yield to maturity or call, and accrued interest To access the bond worksheet, press 2nd BOND Use the ↓ or ↑ keys to access bond variablesYield to Maturity on Both the TI BAII Plus and HP 12C Solve for Y = Yield to maturity Given V = $550 price of bond C t = $80 annual coupon payments or 8% coupon ($40 semiannually) P n = $1,000 principal (par value) n = 10 years to maturity ( periods semiannually) You may choose to refer to Chapter 10 for a complete discussion of yield to maturitySwift & Co, expected dividend, PV, value in 2 or 5 yrs Finance Steps for TI BA II For Exxon bond price calculations Finance Steps for TI BA II Plus for Von Burns dividend yield, capital gain yield Financial Management keystrokes on a TI BA II to solve a YTM, YTC bond problem

Texas Instruments Ba Ii Financial Calculator University Of Toronto Bookstore

Solved Eos 3 3 Johnson Motors Bonds Have 10 Years Remain Chegg Com

Question How Would You Plug This Into The BA II Plus Calculator To Solve?Instructions for using Texas Instruments BA II Plus Calculator by Joel Barber RECOMMENDED INITIAL SETTINGS Note An expression in brackets is a calculator key UP is up arrow (third key first row), and DOWN is down arrow Suppose you wish to solve for the yield to maturity on a fiveyear bond with an $8 coupon and $100 face valuePage 2 Important Information Important Information Texas Instruments makes no warranty, either express or implied, including but not limited to any implied warranties of merchantability and fitness for a particular purpose, regarding any programs or book materials and makes such materials available solely on an "asis" basis

Using The Hp 10b And Ti Ba Ii Plus Financial Calculators

Finding Ytm By Using Financial Calculator Edit Youtube

Yield to Maturity Calculator is an online tool for investment calculation, programmed to calculate the expected investment return of a bond This calculator generates the output value of YTM in percentage according to the input values of YTM to select the bonds to invest in, Bond face value, Bond price, Coupon rate and years to maturityZero Coupon Bond Yield Calculator A Zero Coupon Bond or a Deep Discount Bond is a bond that does not pay periodic coupon or interest These bonds are issued at a discount to their face value and therefore the difference between the face value of the bond and its issue price represents the interest yield of the bondHow to Create a Simple Quadratic Formula Program on the TI and Voyage 0

Ti Baii Plus Tutorial Annuities Tvmcalcs Com

Texas Instruments Ba Ii Plus Ti Ba Ii Bond Duration Bonds Finance

Two daycount methods (actual or 30/360) to calculate bond price or yield to maturity or to call;A Setting Up Your TIBA II Plus The following is a list of the basic preliminary set up features of your TI BA II Plus You should understand these keystrokes before you begin work on statistical or TVM functions Please note that your calculator's sign convention requires that one of the TVM inputs (PV, FV, or PMT) be a negative numberChoose from two daycount methods (actual/actual or 30/360) to calculate bond price or yield to maturity or to call;

Ba Ii Plus Professional Financial Calculator For Cfa Garp Frm Exams

Ba Ii Plus Professional

Using a BA II calculator Finance Steps on TI BA II Plus;Page 124 M = number of coupon periods per year standard for the particular security involved (set to 1 or 2 in Bond worksheet) DSR = number of days from settlement date to redemption date (maturity date, call date, put date, etc) BA II PLUS™ CalculatorTo calculate the YTM, just enter the bond data into the TVM keys We can find the YTM by solving for I/Y Enter 6 into N, into PV, 40 into PMT, and 1,000 into FV

Ba Ii Plus Financial Calc On The App Store

Www Studocu Com En Gb Document Aston University Investments Other Texas Instruments Baii Plus Calculator Instructions View

Texas Instrument Ti Baii Plus Calculatornz S Blog

Ba Ii Plus Professional Calculator

Buy Texas Instruments Financial Calculator Ba Ii Plus Online Shop Stationery School Supplies On Carrefour Uae

6 1 July Outline Tvm Lab Interest Rates And Bond Valuation Ppt Download

Texas Instruments Intros Baii Plus Calculator App For The Iphone Hothardware

How To Calculate Discount Rate Using Financial Calculator Inspiring Video

Texas Instruments Baii Financial Calculator Ba Ii Plus

Bond Price Calculation On The Ti Ba Ii Pus And Professional Calculators Youtube

Solved How Can You Compute This On The Baii Plus Calculator Chegg Com

Texas Instruments Ba Ii Plus Business Financial Calculator Cfa Exam Approved Ebay

Can You Please Help Me To Solve This Using A Financial Calculator Ba Ii Plus Question 6 0 1 Pts Courses Groups What Homeworklib

Texas Instruments Ba Ii Plus Ti Ba Ii Bond Duration Bonds Finance

Texas Instruments Ba Ii Plus Newegg Com

How To Fix Error 5 On Ba Ii Plus Calculators Appuals Com

Financial Management I Review For Fin Ppt Download

Solved Yield To Maturity On Both The Ti Baii Plus And Hp 12c Chegg Com

Bond Valuation Calculations For Cfa And Frm Exams Analystprep

Texas Instruments Ba Ii Plus Newegg Com

Texas Instruments Ba Ii Plus Professional Financial Calculator Iibapro Clm 1l1 D Nayancorporation Com

Texas Instruments Ba Ii Plus Professional User Manual Manualzz

Solved In This Multiple Choice Question L Y And P Y Refe Chegg Com

Using Texas Ba Ii Plus To Calculate Ytm Of A Bond Youtube

000 Instructions For Ti Ba Ii Plus

Ba Ii Plus Bond Ytm Calculation Youtube

Debt Security Yields Types Examples Financial Securities Class Study Com

Mcgraw Hill Irwin Copyright C 14 By The Mcgraw Hill Companies Inc All Rights Reserved Ppt Download

Ba Ii Plus Rate Or Ytm On Bond Youtube

Ba Ii Plus Financial Calc On The App Store

Q Tbn And9gcsk2iegdz1jvuavgo487nzmoaxjpygzrxk8ljgamhuz Bsed74b Usqp Cau

Ti Ba Ii Plus Financial Calculator Advanced W Case Vgc Bk Gy Tested Working Ebay

Ti Ba Ii Plus Ssi Bookstore

Q Tbn And9gctp1y5f6ujqvayk Qvhnumlq3s4rb2atgp2covjbsrnbwdjispl Usqp Cau

Fillable Online Bond Worksheet On Baii Plus Calculator Fax Email Print Pdffiller

Frm Ti Ba Ii To Compute Bond Yield Ytm Youtube

Finding The Yield To Call Of A Bond Using The Ba Ii Plus Youtube

Qgxvulrccbbhpm

1

Texas Instruments Ba Ii Plus Professional Financial Calculator Iibapro Clm 1l1 D Walmart Com Walmart Com

Ba Ii Plus Business Financial Calculator Texas Instruments Cfa Exam Approved Ebay

Ba Ii Plus Tm Financial Calculator Apprecs

Financial Calculators For Business Students By Texas Instruments

Texas Instruments Intros Baii Plus Calculator App For The Iphone Hothardware

How To Calculate The Yield To Maturity Mathematics Stack Exchange

Ba Ii Plus Financial Calculator App Us And Canada

Calculating Municipal Bond Yields Current Ytm Taxable Yield Yield To Call Youtube

Financial Management I Review Ppt Download

000 Instructions For Ti Ba Ii Plus

Ba Ii Plus Financial Calc By Texas Instruments More Detailed Information Than App Store Google Play By Appgrooves Finance 10 Similar Apps 263 Reviews

Ba Plus Pro Financial Calculator Apps On Google Play

Ba 2 Plus Tutorial Bond Yield Calculation Or Ytm Calculation Youtube

Solved I Need The Steps For Calculating The Following Pro Chegg Com

Texas Instruments Ba Ii Plus Professional Calculator Amazon Co Uk Office Products

What Is Yield To Maturity How To Calculate It Scripbox

Texas Instruments Ti Ba Ii Plus Professional

Texas Instruments Ba Ii Plus Advance Financial Calculator Walmart Canada

000 Instructions For Ti Ba Ii Plus

Ba Ii Plus Financial Calculator Us And Canada

Texas Instruments Ba Ii Plus Financial Calculator Office Depot

Baii Plus Professional Tutorial Annuities Tvmcalcs Com

Texas Instruments Ba Ii Plus Adv Financial Calculator Baii Reviews By Customers Real Buyers Reviews Scanreview Com

コメント

コメントを投稿